paying indiana state taxes late

Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a. Created By Former Tax Firm Owners Based on Factors They Know are Important.

Late Filing And Late Payment Penalties Ils

All states have laws that allow the.

. It effectively makes the property act as collateral for the debt. 2021 Tax Returns were due on April 18 2022. 430 pm EST.

ShareThis Copy and Paste. April 15 is the annual deadline for most people to file their federal income tax return and pay any taxes they owe. Ad See the Top Rankings for Tax Help Companies That Fix IRS and State Tax Problems.

Failure to pay tax - 10 of the unpaid tax liability or 5 whichever is greater. At the time of this writing the only states that do not charge a state income tax are Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and. Last updated on September 26 2016.

The April 15 deadline for returns. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Know when I will receive my tax refund.

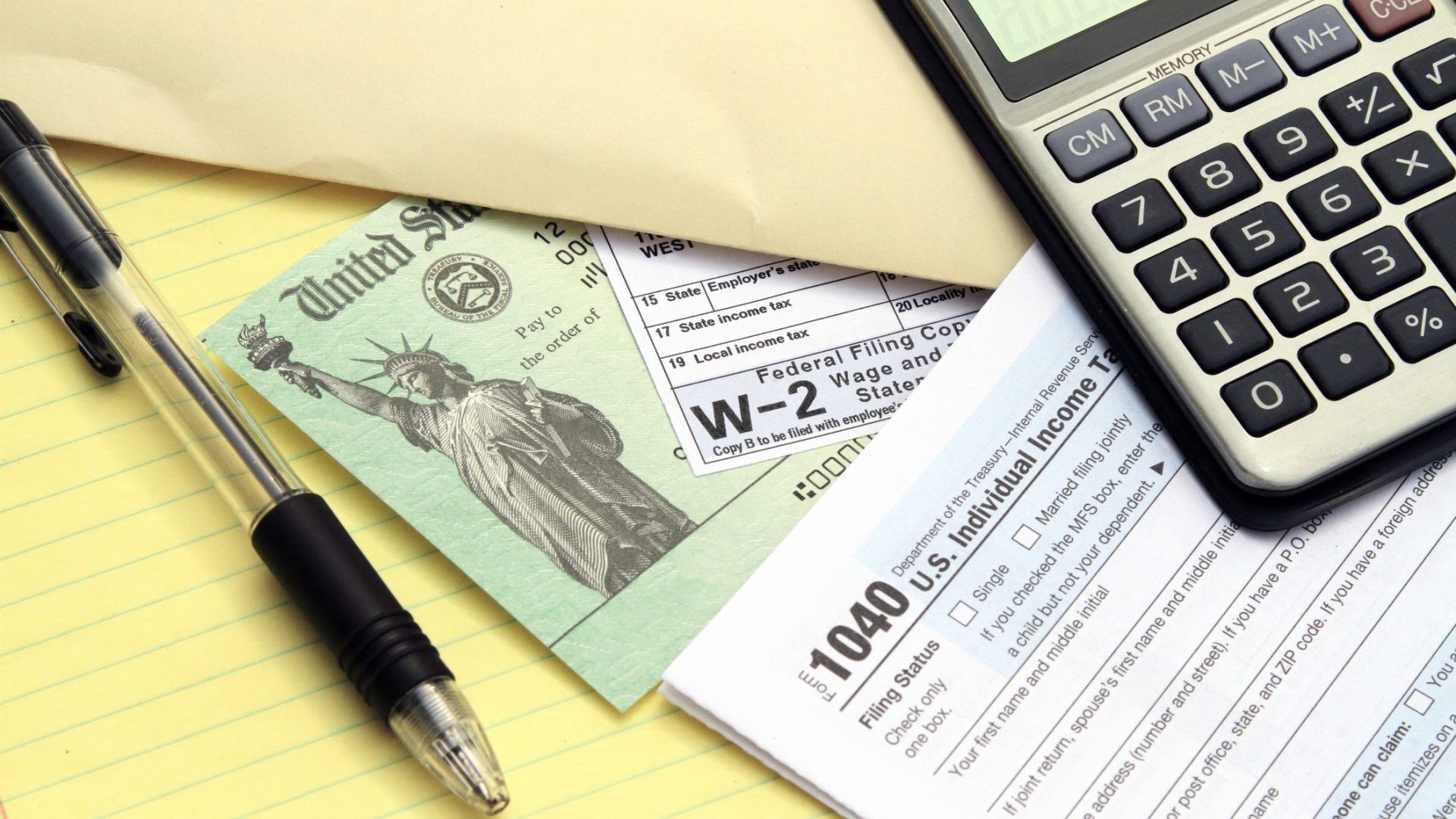

Yesterday the Indiana Department of Revenue announced important income tax filing and payment extensions related to upcoming deadlines. By law the IRS may assess penalties to taxpayers for both. Some states charge a failure to file penalty even if you do not owe anything.

Net 30 Days Less Than 1000 per month. You may face tax late filing andor late tax payment penalties if you file after the deadline and owe taxes. Indianas free electronic filing program for federal and state income tax returns is available to eligible taxpayers who file by this years July 15 deadline.

However you will not. INDIANAPOLIS The IRS extended this years tax deadline for individuals from April 15 to May 17 which means Monday is the final day to file for those of us who operate on. Find Indiana tax forms.

Overdue and costing you. Find Indiana tax forms. Penalties are assessed on late Indiana income tax forms if you dont remit full payment or you owe over 10 percent of your total tax liability to the county and state when.

At any rate failing. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Youll need to provide your Social Security.

For those that pay their sales tax due on time Indiana will offer a discount as well. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax. When you receive a tax bill you have.

Net 20 Days More than 1000 per month. Know when I will receive my tax refund. To check the status of your Indiana state tax refund go online to the INTIME portal or call 317-232-2240 the automated refund line.

2 Government and Politics. Apr 18 2022 Apr 18 2022. The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan.

14 and pay any balance due. State agencies paying their bills late. Estimated payments can be made by one of the following methods.

As a result Indiana taxpayers are paying. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. Reasons to File Late trifold 59459 KB.

If you file a. 13 Investigates has found a troubling practice. If you owe money to the IRS upon completing your tax return its best to make that payment on time.

There are several ways you can pay your Indiana state taxes. Up to 25 cash back A lien is a claim against your property to ensure youll pay the debt. This penalty is also imposed on payments which are required to be remitted electronically but are.

The tax bill is a penalty for not making proper estimated tax payments. WDRB -- Indiana lawmakers said theyre discussing another potential tax refund to provide state residents relief from inflation. Otherwise youll face a late payment.

Indiana state income taxes are due today The Herald Bulletin. If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of Revenue at 317. The cost of paying your taxes late.

Those individuals must file 2021 state tax returns by Nov. Virginia s FTF penalty is 6 per month but only if your tax return is more than six months late. If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am.

Why Teenagers Should File A Tax Return Money

What If I Did Not File My State Taxes Turbotax Tax Tips Videos

Tax Deadline 2022 What Happens If You Miss The Tax Deadline Marca

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Missed The Tax Deadline Here S What To Do Gobankingrates

Do I Have To File State Taxes H R Block

List Of State Income Tax Deadlines For 2022 Cpa Practice Advisor

2022 Tax Day Filing For A Tax Extension Here S How That Works And When Your Taxes Are Due Nbc Chicago

Indiana State Tax Information Support

Indiana Sales Tax Small Business Guide Truic

Income Tax Refund Will You Lose Your Refund If You Missed Deadline Marca

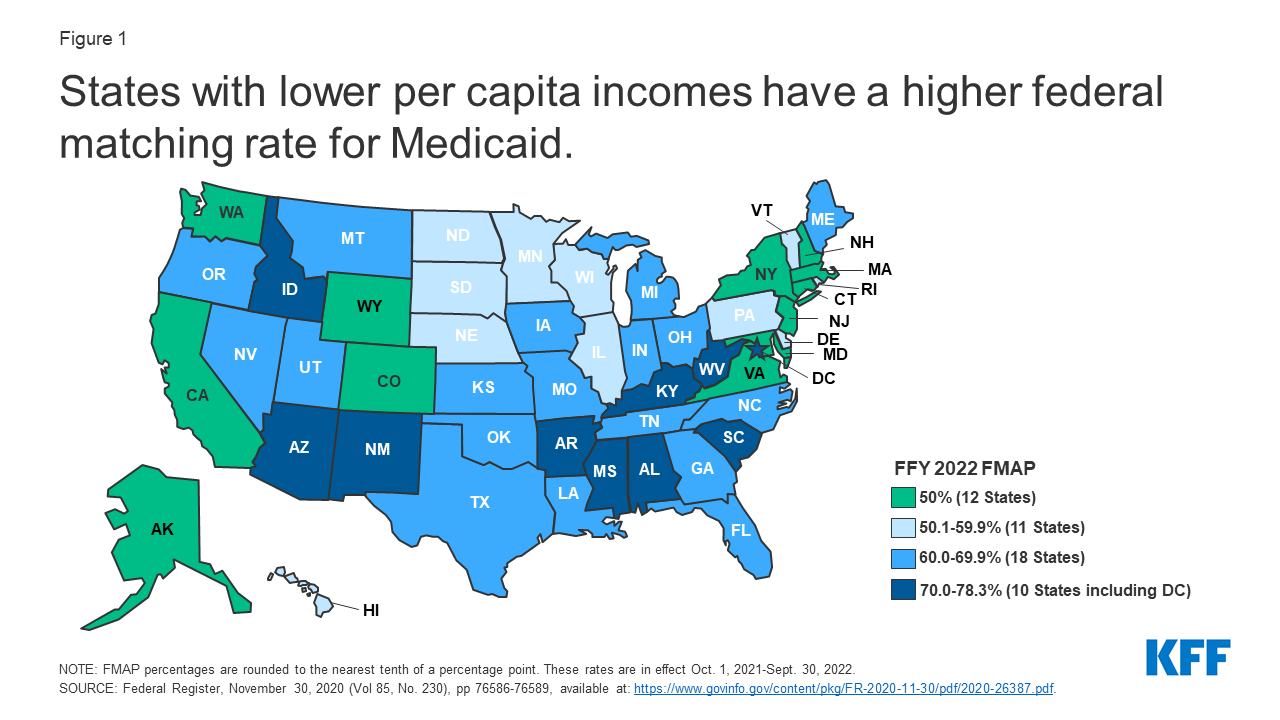

Medicaid Financing The Basics Kff

Preparing Tax Returns For Inmates The Cpa Journal

All 50 States Residential Lease Agreement Landlord Lease Forms Rental Agreement Forms Lease Agreement Landlord Lease Agreement Rental Agreement Templates

Do I Have To File State Taxes If I Owe Nothing

E File Indiana Taxes Get A Fast Refund E File Com

Indiana Sales Tax Information Sales Tax Rates And Deadlines

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation